When you’re ready to sell your business, one of the first questions you might have is, “How much do brokers charge to sell a business?” Merchants are experts who assist you with tracking down a purchaser for your business and guide you through the interaction.They usually charge a fee for their services, and this fee can vary based on the size and type of your business.

In this blog post, we will break down what these fees look like and why brokers charge what they do. By the end, you will have a better idea of what to expect when working with a broker and how to plan for the costs involved in selling your business.

What Are Business Brokers and How Much Do They Charge?

A business broker is a professional who helps you sell your business. They help find buyers, negotiate the deal, and make the selling process smoother. When you hire a broker, they charge a fee for their work. This fee is usually based on how much your business sells for.

Handles for the most part charge a level of the deal cost. So, if your business sells for more money, the broker earns more. For example, if your business sells for $1 million, and the broker’s fee is 10%, they would earn $100,000. It’s important to understand how brokers charge so you can plan for the costs.

Factors That Affect How Much Brokers Charge to Sell a Business

The fees brokers charge can vary depending on a few different factors. These include the size of your business, the industry, and the complexity of the sale. Larger businesses or those in complicated industries might have higher fees.

- Business Size: Bigger businesses usually have higher fees because they require more time and effort to sell.

- Industry: Certain industries, like technology or real estate, may have higher broker fees due to the specialized knowledge needed.

- Complexity: If the sale involves many moving parts, like intellectual property or international buyers, the fee might be higher.

These factors play a big role in determining how much brokers charge to sell a business. It’s important to discuss these factors upfront with your broker.

Understanding Broker Fees: A Step-by-Step Guide

When you hire a broker to help you sell your business, it’s good to know how their fees work. Here is a basic breakdown of what occurs:

- Initial Consultation Fee: Some brokers charge a small fee just for meeting with you and understanding your business. This is usually low.

- Commission Fee: Most brokers earn a percentage of the sale. This is the biggest part of their fee and can range from 5% to 10% depending on your business.

- Additional Costs: Brokers might charge extra for special services, like marketing or finding buyers. These are often agreed upon before you start working together.

Knowing these steps will help you understand what brokers charge and why. It’s important to ask your broker for a clear list of fees before you start.

Is It Worth Paying a Representative to Sell Your Business?

Some business owners wonder if it’s worth paying a broker to sell their business. The answer depends on your situation. Brokers can save you time and effort by handling the details of the sale.

They bring professional expertise to the table, which means they know how to find the right buyers and negotiate better deals. However, the fees can be high, so you should carefully consider if the service is worth the cost.

- Time-Saving: Brokers can handle everything, which allows you to focus on your business.

- Expert Negotiation: They have experience in getting the best price for your business.

- Higher Sale Price: Brokers may be able to secure a higher sale price than you could alone.

If you want a smoother and quicker sale, hiring a broker can be a good investment. It’s vital to gauge the advantages and disadvantages in view of your necessities.

How Much Do Brokers Charge Based on the Business Size?

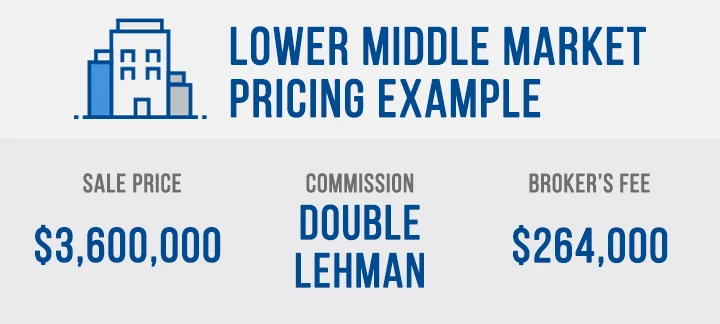

The size of your business plays a big role in how much brokers charge to sell a business. Smaller businesses might have lower fees, while larger ones usually cost more. Here’s how it works:

- Small Businesses: For businesses worth less than $500,000, brokers typically charge between 10% and 12% of the sale price.

- Medium-Sized Businesses: For businesses worth between $500,000 and $5 million, fees usually range from 5% to 10%.

- Large Businesses: For businesses worth more than $5 million, the fee can be as low as 3% to 5%, but this varies depending on the broker.

It’s clear that larger businesses often pay less percentage-wise, but they still end up paying brokers more money because of the higher sale price.

The Different Types of Fees Brokers May Charge When Selling a Business

Brokers can charge different types of fees when helping you sell your business. Understanding these fees will help you make a decision.

- Retainer Fees: Some brokers charge an upfront fee before they start working. This can go from $5,000 to $50,000, contingent upon the intricacy of the business.

- Success Fees: This is the commission brokers earn if they successfully sell your business. It’s typically a percentage of the sale price.

- Marketing Fees: In some cases, brokers charge for advertising and marketing efforts. This can include listing your business on websites and reaching out to potential buyers.

Understanding these different types of fees can help you know what to expect when working with a broker.

How to Calculate Broker Fees When Selling Your Business

Calculating how much a broker will charge to sell your business is important for planning your finances. Here’s how to calculate it:

- Step 1: Find out the sale price of your business. This will be the basis for your broker’s fee.

- Step 2: Know the broker’s percentage. If the broker charges 10% and your business sells for $500,000, the broker would earn $50,000.

- Step 3: Factor in additional fees. Sometimes brokers charge extra for marketing or other services.

By understanding these steps, you can get a good idea of how much you’ll be paying in broker fees. It’s always smart to get a written agreement that includes all fees.

How Much Do Brokers Charge to Sell a Business in Different Industries?

Brokers may charge different fees depending on the industry your business is in. Here’s how the fees can vary:

- Retail and Restaurants: Brokers usually charge between 8% and 12% for smaller businesses in this industry.

- Technology: Tech companies might have slightly higher fees due to their complexity, with fees ranging from 6% to 10%.

- Manufacturing and Real Estate: These industries can have varying fees, but brokers may charge between 5% and 8%.

Each industry has different needs, so the broker’s fee reflects the amount of work involved.

Conclusion

Understanding how much brokers charge to sell a business is important when you are planning to sell. Brokers can help you find buyers, negotiate the deal, and make the whole process easier. However, it’s important to know the different types of fees they charge, like commission fees, retainer fees, and marketing costs. By understanding these fees, you can make a better decision about whether hiring a broker is right for you.

Choosing the right broker can save you time and help you get the best price for your business. Remember to look at their experience, read reviews, and compare fees before making your choice. A good broker can make selling your business much easier, and even though their fees can seem high, they can help you get more money in the long run.